It's Your Money

No matter what they tell you, it’s your money they’re spending.

I’m going to try and tackle something a bit less controversial this week… Inflation.

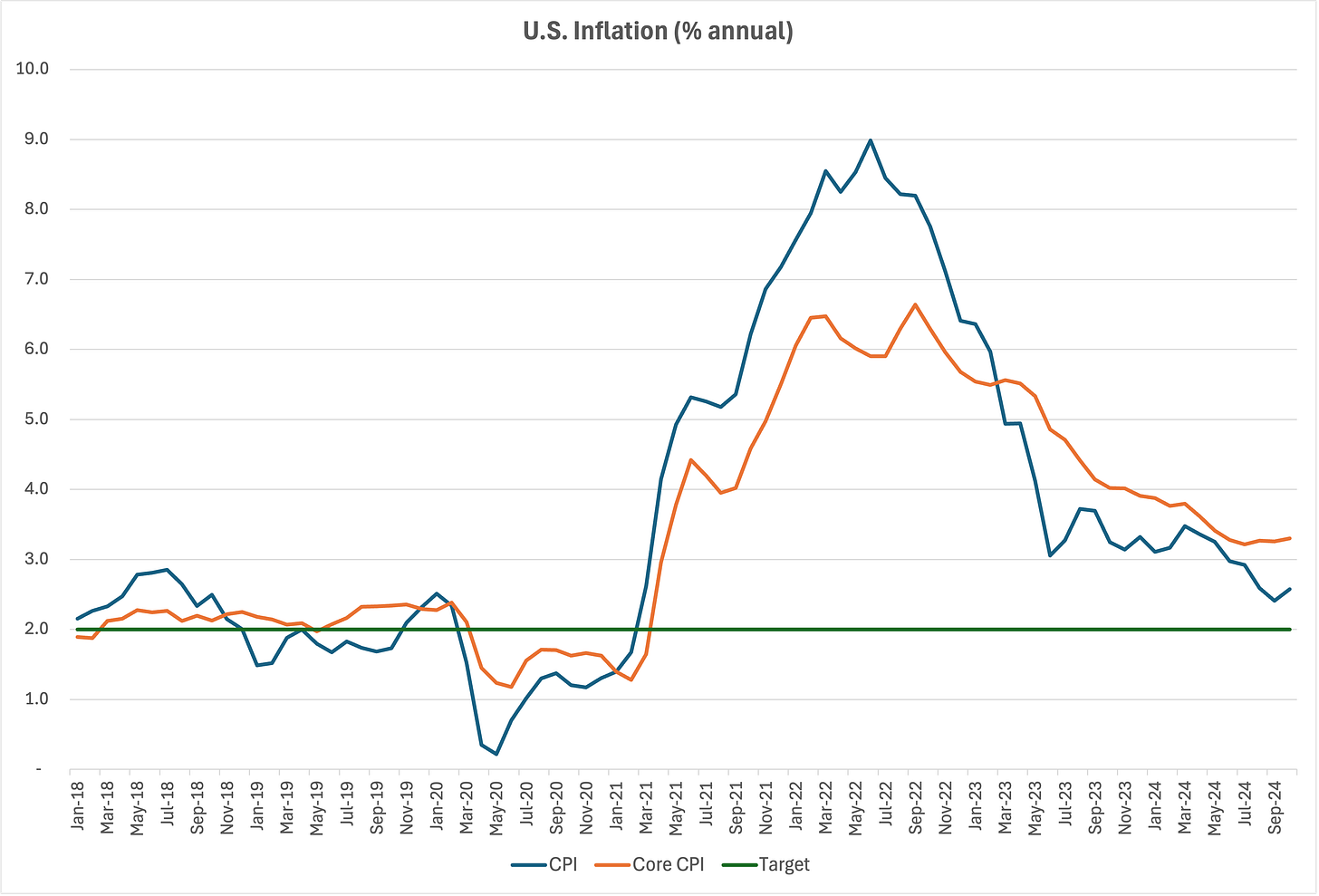

Inflation is not quite defeated. The overall consumer price index (CPI) is running at about 2 1/2 %, close enough to target for my taste. But core inflation, which excludes volatile food and energy prices and gives a better sense of where inflation is trending, has been stuck at 3-3 1/2 % since the spring.

Source: US Bureau of Labor Statistics

Blame game

What caused inflation? The right blamed the Biden administration’s out of control spending; the left blamed global shocks to energy prices and supply chains, and pointed to a similar inflation surge in Europe. Understanding what drove the inflation spike can help us get a better sense of why it’s still so hard to drive it down to target, and of the risks that it might flare up again.

Back to basics

First, the basics: inflation is a persistent increase in the overall price level. In other words: (1) it must be an increase in most prices, rather than just some prices relative to others; and (2) it must continue over a prolonged period.

A sudden shortage of, say, economists (abducted en-masse by merciful aliens) would cause the market price of economists to rise relative to engineers and lawyers, but would not trigger inflation. If something serves as a useful input to other products and services, an increase in its price will make other prices rise. This clearly does not apply to economists, but it is true for computer chips and energy. If supply chain disruptions cause a shortage of chips, this affects the price of computers, TVs and cars. A rise in energy costs raises the price of a wide range of goods and services, because almost everything needs energy.

But unless the price of chips and energy keeps rising, the impact will be temporary. Inflation will remain higher for a while, then fall back to target. Prices will stabilize at a higher level, but they will stop rising fast. This is why, when inflation flared up in 2021, the Fed and most economists initially claimed it would be transitory — they thought it was all due to supply shocks.

Good old demand and supply

When inflation showed no sign of abating, it was clear something else was at play, keeping demand and supply out of balance — prices are always determined by supply and demand, except in socialist paradises where they are fixed by the government…. The Fed eventually admitted that both supply shocks and excess demand were to blame; but ‘excess demand’ means the difference between demand and supply, and the Fed still suggested the problem was mostly a discombobulated supply side.

By now all the supply shocks have faded: oil and gas prices have fallen, supply chains have healed and labor markets have come back into better balance. What remains is the elephant in the room: loose fiscal policy, and in particular elevated levels of government spending that keep excess demand alive.

I do not mean this to be a partisan point. The massive fiscal expansion started under Trump. In my view Trump’s decision to shut down the economy during Covid was a colossal mistake, but once that mistake was made, there was no alternative to keeping us alive with government money. Biden then doubled down with ever-larger spending packages even as the lockdowns were lifted and the economy rebounded strongly, keeping the fiscal deficit at recklessly high levels for an expanding peacetime economy. There’s no guarantee Trump would have done any different. In fact, as I noted in a previous post, Trump’s 2024 election promises were vastly more generous that Harris’ (which were already quite irresponsible).

The wrong question

How could US fiscal policy have caused inflation in Europe? It didn’t. But you’re asking the wrong question. The right question is whether Europe also launched a massive fiscal expansion in response to the pandemic — and the answer is yes.

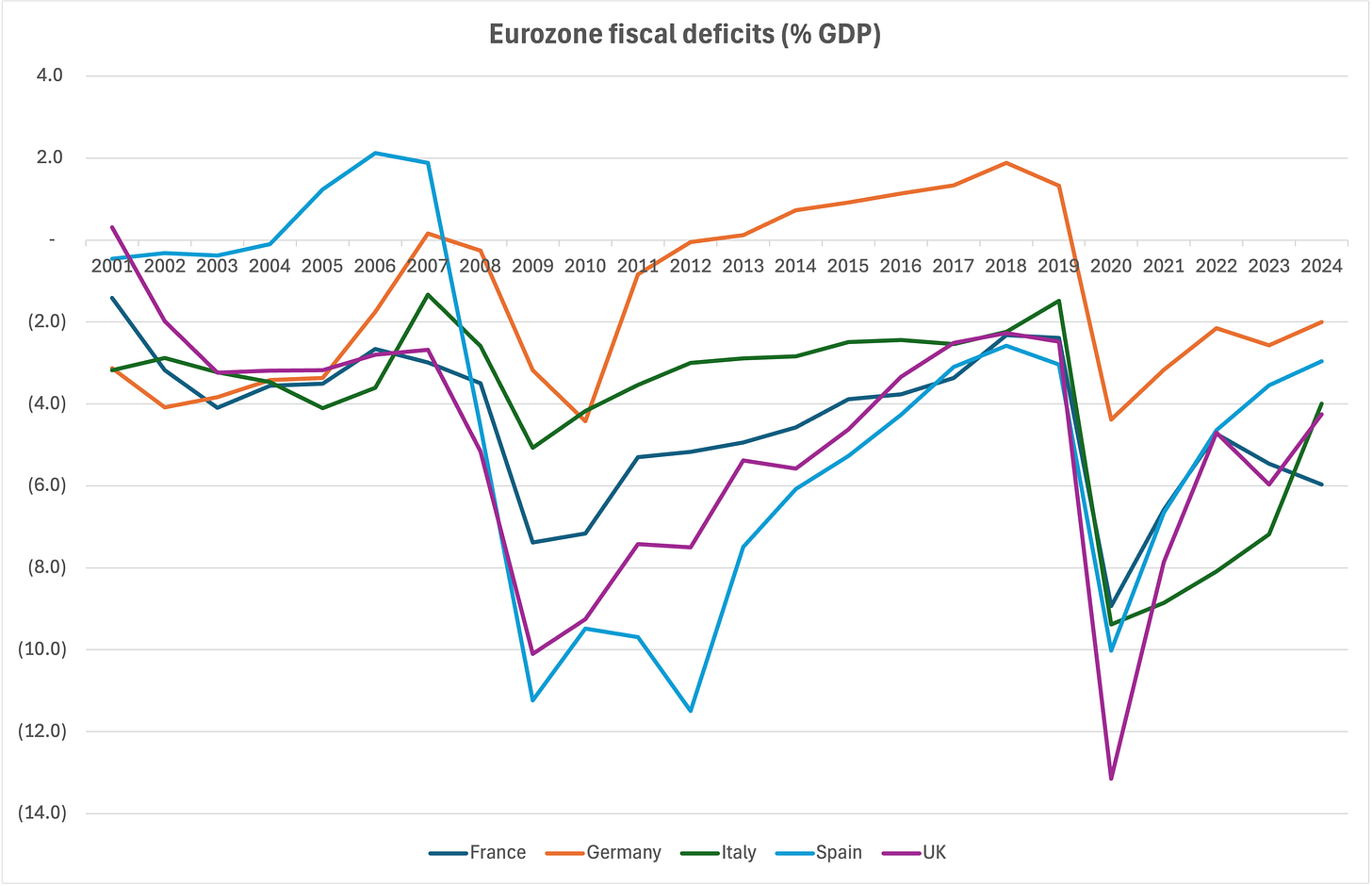

Source: IMF

With the laudable exception of Germany, European countries also blew the budget. Over 2020-23, Italy ran a cumulated fiscal deficit of 33.5% of GDP; the UK 32%; France and Spain about 25%. They all stand up well to the US’s 36%.

Loose fiscal policy is a great way to keep demand running ahead of supply — especially when it is supported by loose monetary policy that fuels abundant credit and keeps borrowing costs low.

A recent European Central Bank paper argues that inflation in the euro area was also largely driven by excess demand, like in the US. For a long time, even after the Fed recognized the role of excess demand in the US, the prevailing argument was that euro area inflation came almost entirely from the energy price shock, given Europe’s heavy reliance on Russia’s gas. The ECB paper notes that euro area inflation had already risen above 5% before Russia invaded Ukraine.

Unpleasant taxation arithmetic

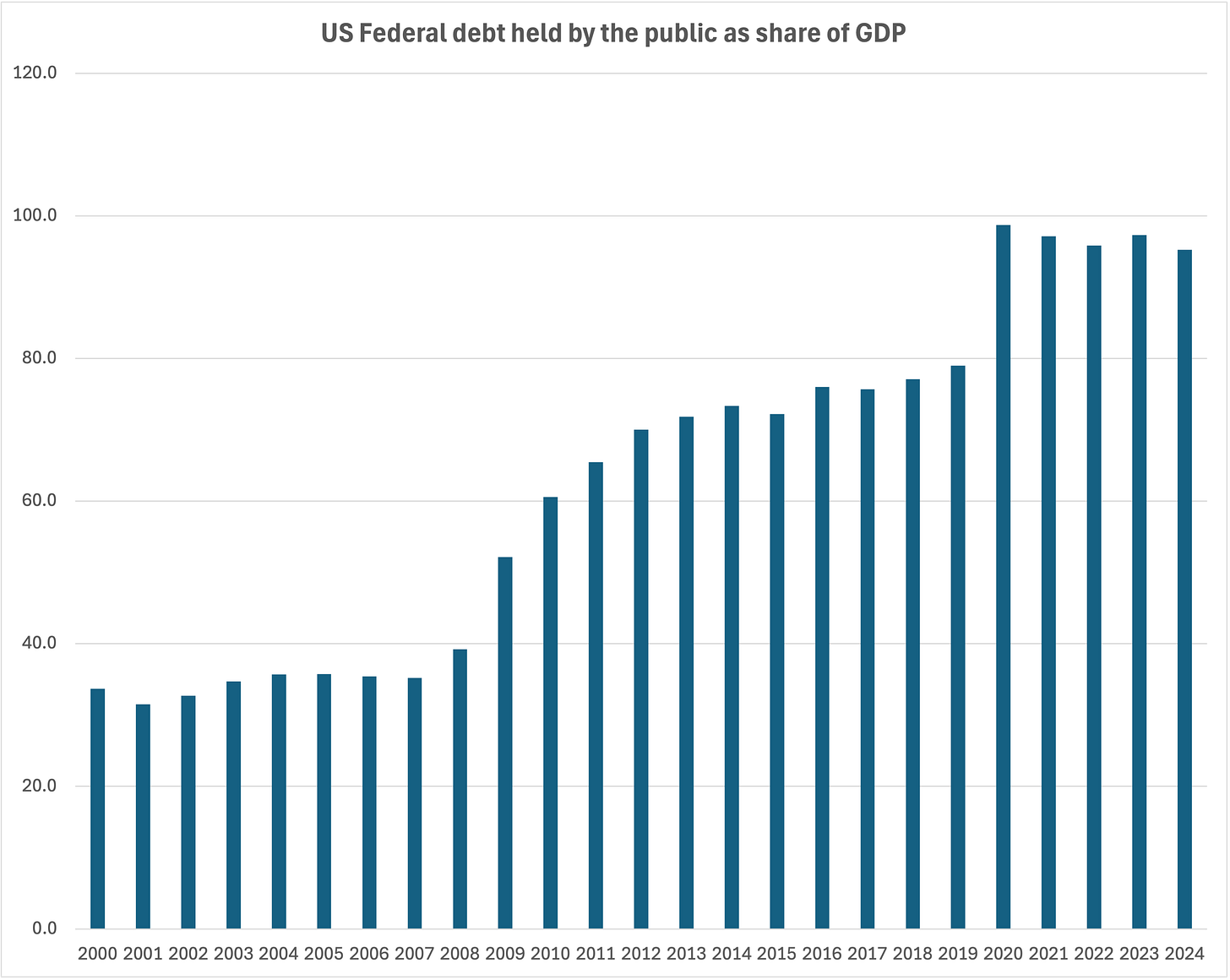

Now, in the best economics tradition, it’s time for some simple unpleasant arithmetic. The chart below shows the path of US federal debt held by the public as a share of GDP:

Source: US Office of Management and Budget (2024 data as of Q2)

You can see the big jump in 2020, corresponding to the first pandemic package. What’s less eye-catching but more striking is what happens next: over 2021-24, the US has run a cumulative fiscal deficit of close to 30% of GDP. And yet, unlike in 2020, the debt to GDP ratio actually declined by 3 percentage points between 2020 and 2024!

Magic? Kind of. Let’s break it down. The debt to GDP ratio is the debt in US dollars divided by nominal GDP, which in turn is the volume of the goods and services we produce, multiplied by their prices. While the fiscal deficit pushes up the numerator, economic growth and inflation raise the denominator. In dollar terms, the stock of debt increased by 6 trillion, or 28%, as of Q2-2024. About one-third of this was “financed” by stronger economic growth: the US economy expanded by 12% over the same period. A twice-as-big amount was eaten away by inflation, with CPI rising a cumulative 20%1. Inflation redistributes money from creditors to debtors — in this case from us to the US government. In other words, the pain that households have suffered in terms of curtailed purchasing power is in large part a stealth tax levied to finance huge government spending.

Forget tariffs. The big issue here is fiscal policy. And remember, no matter what they tell you, it’s your money they’re spending.

Again, this is not meant to be a partisan point. It is a cautionary tale. If fiscal policy remains out of control — as Trump’s campaign promises would imply — inflation will remain elevated and might increase anew. If it doesn’t, the debt to GDP ratio will rise and cause higher borrowing costs — the Fed already seems to be getting cold feet about further deep rate cuts. And at some future point taxes will have to rise.

The optimistic view is that business friendly policies will boost economic growth enough to offset the spending. I don’t think that’s realistic. Business friendly policies will offer a brighter growth outlook than we would have with higher taxes and more regulation, but nowhere near bright enough to offset a potential cumulated deficit of about 27% of current GDP.

Forget tariffs

By comparison, concerns about the inflationary impact of tariffs are overrated. Tariffs would be a one-off shock. The tariffs imposed in the first Trump administration had no discernible impact on inflation, though they did make some imported goods more expensive. Even more aggressive across-the-board tariffs triggering a tit-for-tat response would only have a modest and temporary impact on inflation, as ECB’s Nagel also pointed out in recent statements. And to the extent that they do have an impact, tariffs will not “make foreigners pay” for US government spending — the revenue impact will be small and we will pay higher prices.

So, forget tariffs. The big issue here is fiscal policy. And remember, no matter what they tell you, it’s your money they’re spending.

Opening image credit: Frank van Hulst for Unsplash

Technically I should be using the GDP deflator here, I know, but the bottom line is the same

I guess I will never stop learning, my dear friend. This time you’ll have to forgive my sarcasm, but I can’t really take the analysis seriously considering a clearly partisan editorial; a harsh critique of Biden’s policies (ignoring what he inherited) and the MUCH softer framing of Trump’s actions. Again, in fact, you judge the Chief Executive or a tenant for the way he/she finds the house... not the way he/she leaves it.

For instance, inflation is a stealth tax now? Of course, it is... since it usually pops up in the form of an executive order or an edict. Something Biden did and Trump will reverse with the red switch conveniently placed on the right side of the Resolute Desk. After all, who wouldn’t recommend the President increase inflation? It’s rule number one in the book, "How to Lose Your Reelection".

And here I was thinking it had something to do with, you know, a global pandemic, supply chain chaos, a war in Europe, and central banks playing rate-hike roulette. Silly me for thinking it was a bit more complicated. Clearly, Biden’s fiscal policies are so powerful they even managed to inflate gas prices in Italy. Was he on a Zoom call with OPEC, or was Janet Yellen running that one while sipping her matcha oat latte?

Also, I have to say, the alien economist-abduction scenario is a bold touch. A terrifying supply shortage we should all worry about! But if economists suddenly become scarce, should we start hoarding lawyers? Seems like a solid backup plan.

And then there’s the wild claim that tariffs on China didn’t (and won’t) affect inflation. Sure, let’s just ignore how raising import costs directly increases the price of goods here. It’s not like we all saw prices jump on everything from electronics to basic goods when those tariffs kicked in, right? Let me guess... next, you’ll argue a 25% tariff on semiconductors would have no impact because apparently, chips grow on trees now.

Anyway, glad to see we’ve cracked the code: it’s all just government spending and taxation. Forget years of Fed’s ultra-low rates or, I don’t know, that tiny little event called COVID. But hey, if it’s all about 'your money,' maybe your next post can dive into how aliens caused the housing crisis. I’d definitely tune in for that one.

Last but not least, can you please tell Florida to stop burning books? They’re clearly out of the playbooks on gender adjustments and have moved on to the good stuff, like economics. Let’s save some classics for the next debate!

😘