Discover more from Just Think, by Marco Annunziata

Industrial policy is all the rage, embraced by both US presidential candidates and favored by parties across the political spectrum in countless countries. Now even the International Monetary Fund, in its latest Finance & Development magazine, gives pride of place to Mariana Mazzucato’s article “Policy with a Purpose: Modern industrial policy should shape markets, not just fix their failures.”

Mazzucato, an economics professor at University College London, has long been a proponent of broader government intervention. Her doctrine could be summed up as “governments do it better,” where “it” includes growth and innovation. Rather predictably, her IMF piece sports an image of the 1969 moon landing: Kennedy’s moonshot is taken as proof of the government’s awesome ability to generate innovation. There is a key difference between the original “moonshot” and modern industrial policy, however.

“Because they are hard”

“We choose to go to the moon. We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win... ” President John F. Kennedy, address at Rice University, September 12, 1962

The original moonshot was underpinned by a moral imperative — championing freedom against communism (so it’s especially ironic to see it used to justify a socialist turn in policy). It set one well-defined goal — going to the moon — not because it would benefit individual industries or sectors of the population, nor because it would bring economic value, but because it would unleash “the best of our energies and skills”.

To this purpose, much of the massive public investment effort went into basic scientific research, through NASA and in partnerships with private universities and companies. Investment in basic research together with the excitement generated by the space program pulled lots of talented young minds into science: the share of US bachelor’s degrees in science and engineering peaked at the time of the moon landing.

The government also invested heavily in fields like computing, communications, material science, electronics, and this investment sparked innovations that percolated through civilian applications. Its impact was huge. But most of this innovation was carried out by a rich ecosystem of private companies that ran with it, especially as private funding became stronger (with the help of significant tax rate cuts in the mid-1960s). The space program spurred a powerful productive synergy of public and private innovation and ignited an enthusiasm for science that bolstered human capital. But to imply that this innovation would never have happened without the government’s intervention goes one step too far.

if governments truly were better than the private sector at generating innovation and growth, Europe would be light-years ahead of the US.

Innovation

Invoking the moonshot suggests that without the government in the game we are missing out on life-changing discoveries. But innovation is alive and well. Innovation has never been faster. Artificial Intelligence, quantum computing, 3D-printing, digital-industrial technologies, self-driving cars, drones, flying taxis, synthetic biology and gene editing, bioprinting, virtual reality, augmented reality, wearable technology, telesurgery, robotics, Alexa, Siri,… does it feel like innovation has stalled without the government’s guiding hand?

If you are not convinced yet, here is a quick and easy reality check: if governments truly were better than the private sector at generating innovation and growth, Europe would be light-years ahead of the US. Instead it’s falling further and further behind.

It’s a classic sleight of hand: cite NASA’s past success at seeding innovation to justify new policies that are mostly aimed at protecting traditional established industries. Kennedy said, “we choose to do these things because they are hard”; modern industrial policy just aims to make life easier for selected industries.

Money

There is another important consideration, one that the IMF should know better than anyone else: the private sector is now much better placed to deploy resources efficiently and at scale than the public sector.1 Space exploration itself provides the best example: the space race has been re-ignited by the private sector, led by Elon Musk’s Space X, which has proved far more efficient and effective at launching rockets into space than government.

Moreover, most governments are now strapped for cash, having spent liberally on unproductive causes, from untargeted social subsidies to a plethora of ill-conceived projects. If they really want to play a role in fostering innovation and growth, governments should put their house in order first.

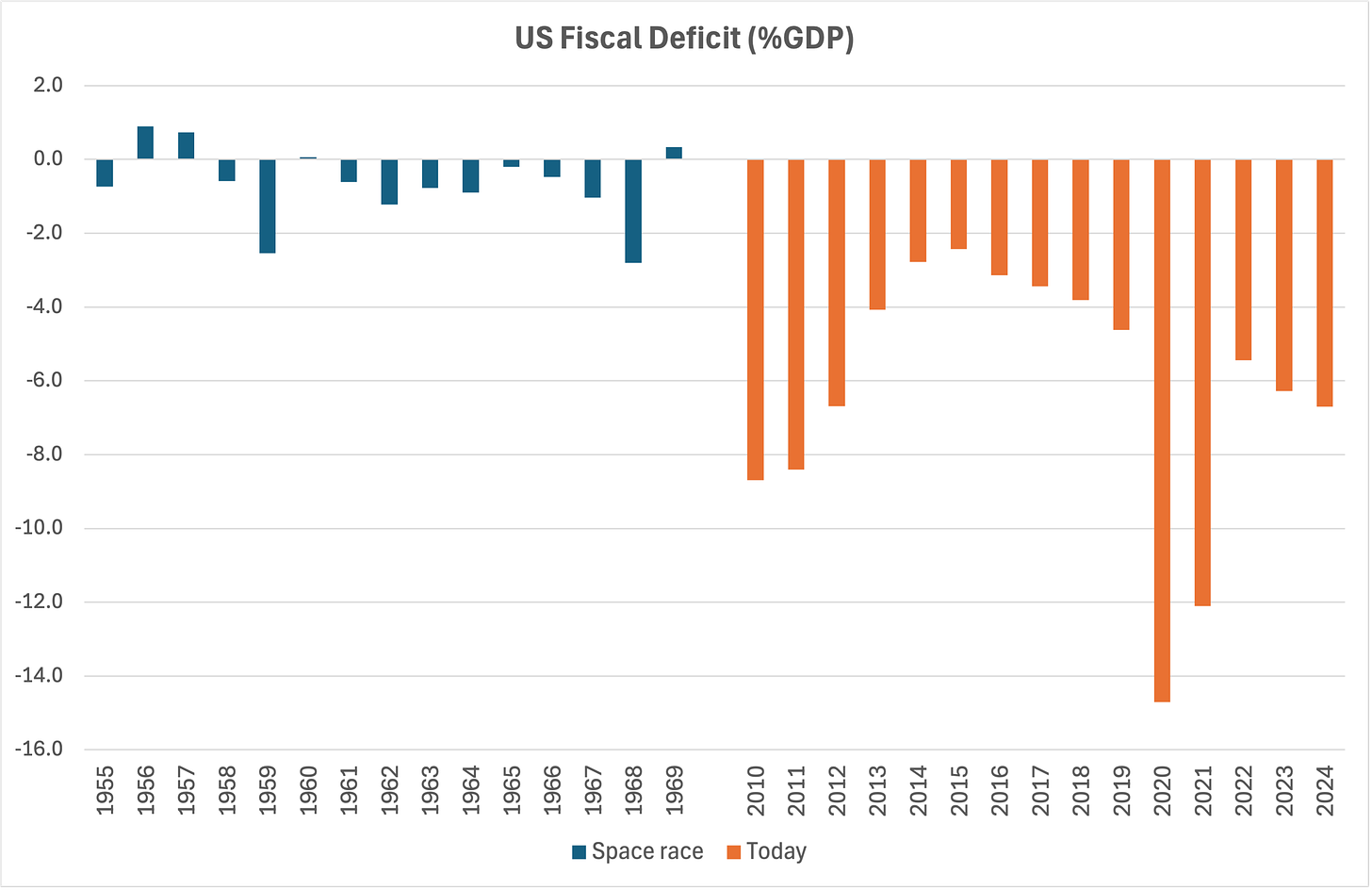

Advocates of industrial policy insist that governments should boldly spend and borrow to spur growth and innovation. After all, the space race saw a massive government investment effort — shouldn’t we be willing to spend and borrow as much today? Well…:

Source: U.S. Office of Management and Budget via St. Louis Fed FRED database

During the space race (1955-69), the US government’s deficit averaged just two-thirds of one percent of GDP per year; since 2010 it has averaged over 6% of GDP. We’re overspending and borrowing 10 times more, as a share of the economy. And yes, that’s right: we went to the moon on a balanced budget.

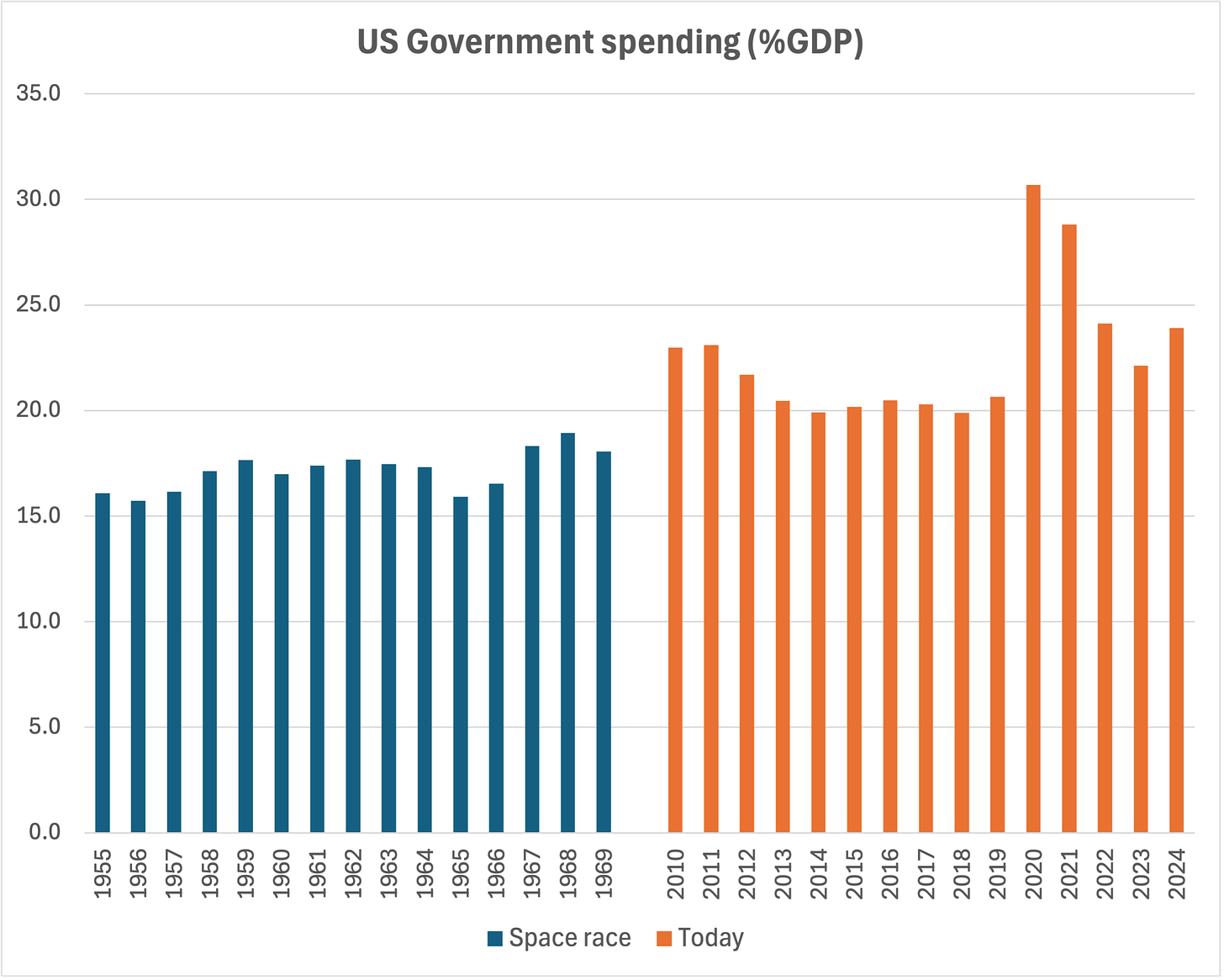

Surely that’s because of some crazy tax cuts so that now the government can’t spend as much? Well…:

Source: U.S. Office of Management and Budget via St. Louis Fed FRED database

Government spending since 2010 has been on average 5 1/2 percent of GDP higher than during the space race, matching the difference in deficit levels. Government expenditures today are over 30% higher than during the space race, in real terms.

So don’t tell me the problem is we’re not spending and borrowing enough. As I said, governments should put their house in order first.

The failures of today’s public sector are awe-inspiring: unsustainable debts, the aiding and abetting of a historic financial crisis, bankrupt health and pension systems, the highest inflation in half a century, the catastrophically irrational response to the Covid pandemic, immigration non-policies that are fueling racism and social instability. You want this public sector to “direct growth and shape markets”?

Have you seen a government lately?

To dodge the issue of fiscal sustainability, advocates of industrial policy invoke an existential threat (climate change) to justify immediate additional spending. Mazzucato’s IMF-hosted piece makes an even broader claim: left to the private sector, economic growth can veer in dangerous directions, harming the planet and workers. “Economic growth is worth striving for only if it’s sustainable and inclusive,” she writes. Hence, government must direct economic growth, to make sure it’s sustainable and inclusive.

This line of argument is more dangerous than the problems it aims to solve. Free markets aren’t perfect, but we do have solutions. Wherever we think workers are being exploited, let’s review the relevant laws. If we think carbon emissions need to be eliminated, let’s set carbon pricing accordingly — and accept the economic cost. Because if perfect governments are an illusion, so is the perfect government. Today’s public sectors more closely resemble Peter Sellers’ bumbling Inspector Clouseau — getting things right rarely and by chance.

I have no doubt that an enlightened government, led by politicians with the country’s future at heart and staffed by competent and honest bureaucrats, could help us reach strong, sustainable and equitable growth. But that’s not the government we have. We are asked to believe that the same governments that wasted money with abandon for the past twenty years can now efficiently “direct growth and shape markets” through a complex web of incentives, subsidies, taxes, public-private partnerships, procurement contracts, all replete with a profusion of conditionalities aimed at achieving a multitude of environmental and social objectives — as the article advocates2. That’s a big leap of faith.

Ironically, Mazzucato herself makes the best case against industrial policy. Towards the end she notes, “Industrial policy requires a competent, confident, entrepreneurial, and dynamic public sector.” Well, that’s exactly what we do not have. Confident, maybe, but virtually no country today can boast a competent, entrepreneurial and dynamic public sector (Singapore being a notable exception). The failures of today’s public sector are awe-inspiring: unsustainable debts, the aiding and abetting of a historic financial crisis, bankrupt health and pension systems, the highest inflation in half a century, the catastrophically irrational response to the Covid pandemic, immigration non-policies that are fueling racism and social instability. You want this public sector to “direct growth and shape markets”? Please. Let’s fix the public sector first, then we’ll talk.

Opening photo credit: Photo by NASA on Unsplash

Once, cash-strapped countries facing a balance-of-payments crisis had no alternative but to turn to the IMF. Then private financial markets grew in size and efficiency, and countries willing to put better policies in place can now raise financing on the private market.

The article itself highlights a typical reason why industrial policy can too easily fail: governments trying to reach multiple goals in a classical pork-barrel approach. Mazzucato praises the fact that “In the US, companies can access funding under the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, a key prong of the Biden administration’s industrial strategy, only if they commit to climate and workforce development plans. They must also provide accessible childcare, pay certain workers prevailing wages, invest in communities in consultation with local stakeholders, and share a portion of profits above an agreed threshold for funding of $150 million or more. Stock buybacks are excluded from CHIPS funding, and the legislation discourages them for five years.” With so many extraneous considerations thrown in, chances of reaching the main objective — spurring domestic production of advanced microchips — are greatly diminished.

Subscribe to Just Think, by Marco Annunziata

Stepping away from groupthink, with a focus on economics and innovation

Excellent points, as usual, Marco. And I broadly agree with your arguments and am very worried that the 'small yard' we plan to protect with a 'high fence' is going to grow quickly over time. Having said that, most of what the Biden Administration is doing is offering incentives to private actors to deliver electric vehicles. It is not setting up a Climate NASA to do the job itself. Also, I would point out that SpaceX is an amazing story, but still depends heavily on a big client called NASA. And last, I think it's unfair to suggest our budget deficits are expanding because of industrial policy. As you know, our biggest expenses are social transfers. Another problem altogether ... Nice piece.

OK, so much to digest here. Let me share a couple of immediate comments:

1) Your long list of innovations is indeed impressive, and if governments were in charge, Moore's Law would sadly and quickly mutate into Murphy's Law. However, and this is a relevant point I feel, innovation is 'good'—economically, and I suspect also socially—only inasmuch as it sustains productivity, meaning that with them, we can do more (or the same) with less. Now, I think we agree the productivity bump we’ve seen so far is quite underwhelming. So, the question here is: are we investing in the right things, or are we just distracting people? (i.e., does Alexa have a secret mission?). Not that I think governments have the slightest clue about it.

2) On your point about the quality of government: I couldn't agree more. I look at our generation of politicians and want to ask, how did we get here? I listened to a radio show last week where the host lamented the disappearance of 'diplomats' (unless we’re ready to admit that the new Kissinger is Blinken). The accumulation of debt is just one of many signs that the government is as irresponsible as the roughest private entrepreneur.

3) Mazzucato is a hopeless romantic. She seems to think the government has the long-term destiny of its citizens in mind. May I dare to say: they don't give a damn. Look at the German government: only agreeing to DSV buying DB Schenker after the Danish company promised not to lay off German staff; or Chancellor Scholz stating that UniCredit’s attempt to snatch Commerzbank is 'inappropriate' (an odd choice of adjective and timing, given Draghi’s recommendation for EU financial integration). Look at Emmanuel Macron's mercurial call for a general election in France, supposedly to prevent the far right from coming to power, only to form a government that excludes the left (who won the election) and fundamentally depends on the far right's mercy. Look at Joe Biden, who will provide Ukraine with long-range weaponry as long as Zelenski doesn't use them against Russia (perhaps implying Ukraine should attack the Moon instead)... I could go on. Everyone just wants to be re-elected. Yes, even Biden, before... well, you know.

4) Mazzucato is a hopeless romantic (2.0). What is the left interested in nowadays? Industrial policy? Boring! Adding unnecessary 'neo-pronouns' (latest notable additions: ze/hir, xe/xem, fae/faer): GREAT VALUE TO SOCIETY! Green? OH YES, FOSSIL FUELS: KILL THEM ALL. Merit as a value in schooling: BOOOOOOO. This comes from someone (me) who is theoretically very interested in what the left could offer society, but who feels kind of betrayed.

5) The irony is that the absence of quality, long-term government is making the private sector more 'dangerous.' Isn’t the unbridled development of social media having much more severe consequences than merit in schools? If you want to have a (bitter) laugh, look at this: https://www.bbc.com/news/technology-53476117