For A Few Barrels More

The Iran endgame matters well beyond oil prices

In Iran, demonstrations seem to have waned after the dictatorship killed thousands and jailed close to twenty-thousand. The initially threatened US intervention seems off the table. We don’t really know — the situation is still fluid and official statements, shall we say, not fully credible. When the Iranian people took to the streets, foreign experts fell in two camps. Some hopeful we would see the fall of Iran’s islamic regime and a transition to democracy. Others warning that the dictatorship would likely survive or be replaced by an equally authoritarian successor.

How this plays out will have important repercussions for the global geopolitical and economic outlook. Meanwhile, developments in Iran offer a good opportunity to go back to basics on a few issues.

Institutions and law

We agonize over the state of US institutions, but Iran reminds us that a basic precondition for strong institutions is the separation of church and state. The law of the state must supersede religious law. In Iran, religion is the law — it’s the ‘Islamic Republic of Iran.’ That, it appears, leads to some unpalatable consequences. This basic precondition can’t be emphasized often enough.

International law provided no succor to the women and men being imprisoned, tortured and murdered in Iran. That’s an internal affair and international law says other countries have no right to meddle as long as international peace isn’t threatened. We must stand by while the dictatorship slaughters thousands of its citizens. I’m a law-and-order kind of guy, but this makes me uneasy. There is also the small matter that Iran has been fomenting terrorism abroad and threatened the destruction of Israel; not quite internal affairs, but here again international law seems silent, or at least toothless.

What’s new, pussyhat?

Do we care? Sadly, the Iranian insurrection has exposed a sickening double standard: no demonstrations anywhere on western college campuses or in the streets of New York and London (other than by Iranian expatriates); no principled statements by high-profile mayors; only late and reluctant attention by most media. I know we can’t care about every injustice, but the contrast with pro-Gaza activism is striking. I see only two explanations, not mutually exclusive, neither one flattering: either we care only when someone tells us we must, like dutiful sheep; or our concern is largely fueled by antisemitism, so that if we can’t blame Israel and the jews, we don’t care.

The “pussyhats” have remained in the drawers. Between end-2016 and early-2017, hundreds of thousands of people across western cities took to the streets in the “pussyhat protests,” to show their deep concern for the fate of women in the US. None seem to care about the young Iranian women who have been courageously at the forefront of the insurrection, rebelling against draconian religious restrictions, risking and losing their lives. Some women’s rights, I suppose, are more equal than others.

Oil

Venezuela and Iran have one thing in common (besides dictatorship): oil. For Venezuela the focus has been on the potential long-term upside. From less than 1 million barrels per day, production could rise back to over 3 million, but it will take time and investment to reverse the damage that Chavez and Maduro have inflicted on their own oil industry.

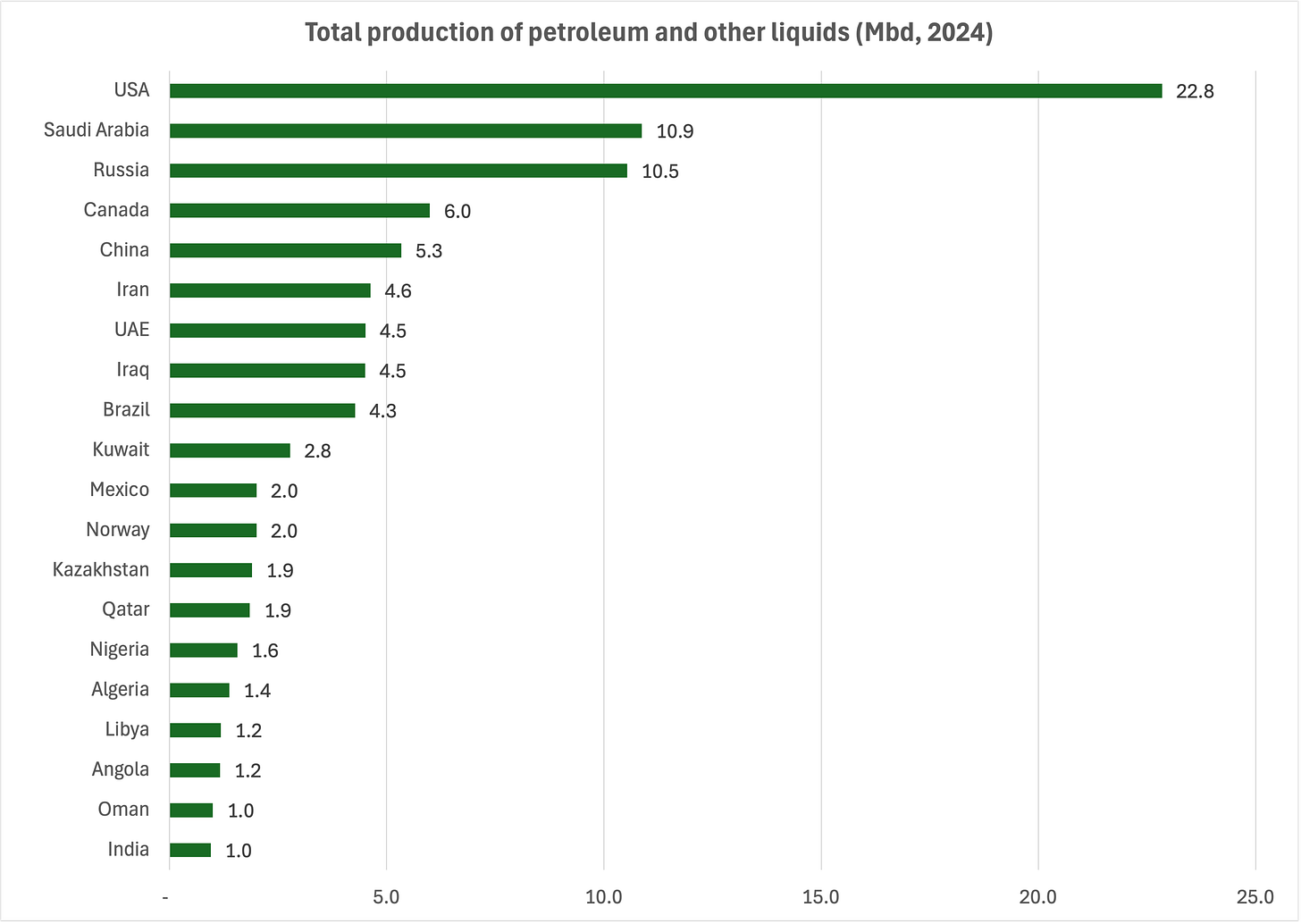

In Iran we face both upside and downside risks already in the short term. Iran is a bigger player in the oil market, accounting for about 4% of world crude oil production to Venezuela’s 1%. To put things in context, the US accounts for 22%, twice as much as runners-up Saudi Arabia and Russia.

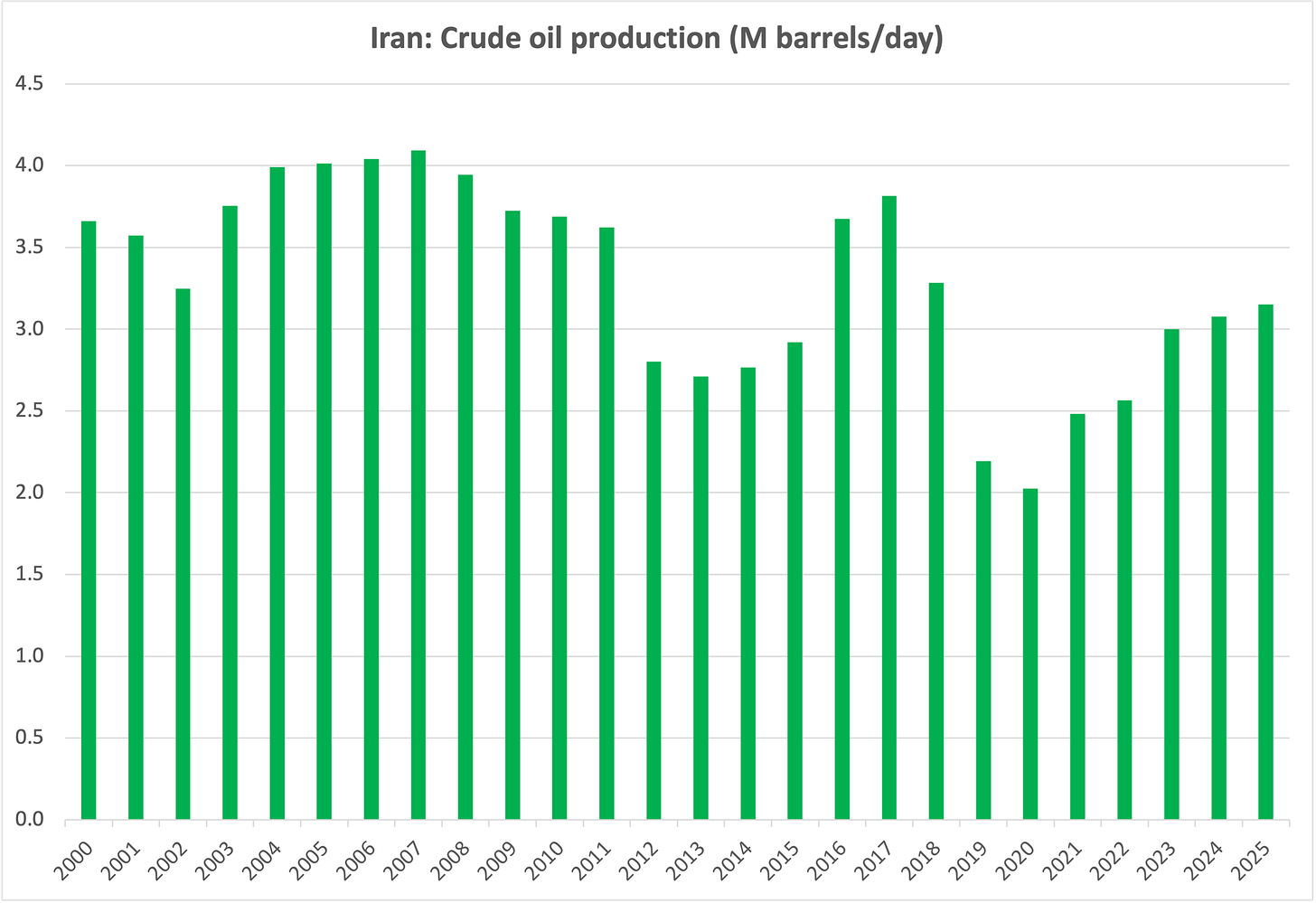

Iran now produces some 3 Mbpd, about 1 million below the peak of the mid-2000s, and 1 million above the nadir of 2020. (Venezuela around 800-900k).

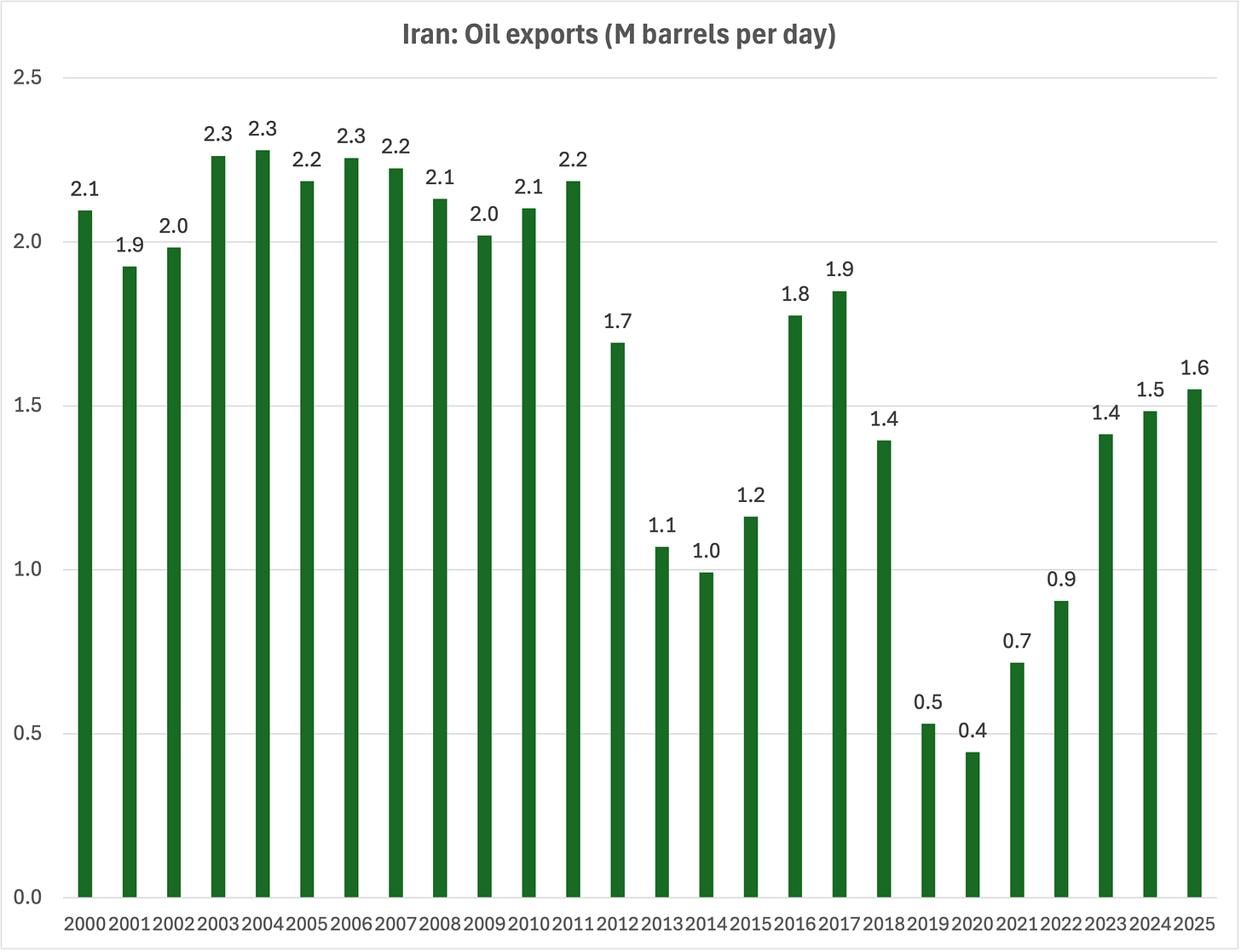

Iran’s oil exports are a more interesting story. At 1.6 Mbpd, they are not too far below their 2.2-2.3 M peak of the mid-2000s, and a lot higher than the 400k level of 2020, when sanctions were biting hard (compounded by the Covid slowdown). The export rebound of the last few years reflects largely demand from China, which now buys 80%-90% of Iran’s oil, enjoying close to a $10 per barrel discount compared to market prices. To put things in perspective, China consumes over 16 million barrels a day compared to a domestic production of just over 5 million. The US produces close to 23 million and consumes over 20 million (2024 data, EIA).

Imagine a dream-case scenario where Iran transitions to a stable democracy focused on raising living standards at home rather than seeding death and destruction abroad. The upside would be meaningful, but asymmetric. Sanctions would be lifted, and oil exports would increase; Based on past analysts estimates, higher Iran production and exports might lower global crude oil prices by $5-15, other things equal (which of course they never are). China however would no longer be a preferential buyer (or oil-launderer, if you prefer) and would no longer access substantial oil supplies at a discount.

An additional, substantial benefit would be increased stability in the Middle East region, and reduced risks of disruption to the Strait of Hormuz. This would be in everyone’s interest, including China.

In the nightmare scenario, domestic chaos could result in reduced production and exports, and potentially broader disruption in response to a hypothetical intervention by the US and or Israel. While the upside is limited by Iran’s production capacity, the potential downside is much larger, as it might impact oil output and exports by other players in the region.

If protests have been smashed for good, a continuation of the status quo would open the question of how quickly Iran can return to finance and foment terrorism — a not insignificant threat to our cherished international order.

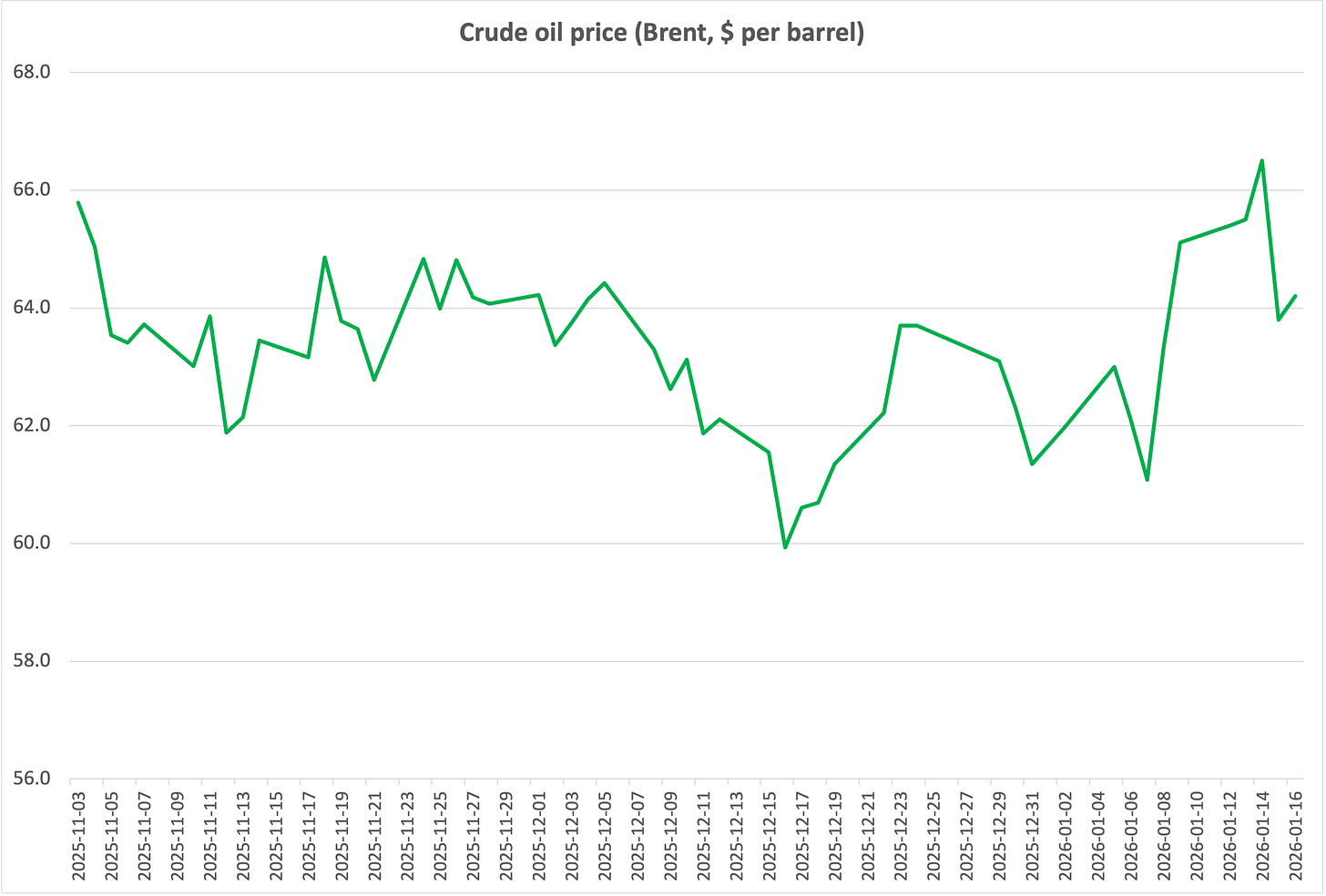

Brent oil prices briefly spiked to over $66 per barrel, about $2 above the prevailing level in December before the protests started, and $5 above the early-January low. We’re now back at December levels.

Barely a ripple. Similarly the VIX index, which measures stock markets volatility, has remained relatively stable. Markets seem to predict the status quo will win.

If they’re right, we can rejoice in the knowledge that international law was not violated this time, and the EU can go back to “closely monitor” Venezuela and ready its troops to face the US Marines in Greenland.

But maybe it’s too early to tell.

Anyway, why should we care? For a few barrels more?

Marco,

I found your point on the 'sickening double standard' interesting, but I believe a more central geopolitical factor is at play for the lack of major demonstrations in the West.

People often feel a greater moral obligation to protest when their own government is allied with or perceived as complicit with the regime being protested (as is the case with Israel and Western allies). Since Western governments are already adversaries of the Iranian regime, that sense of direct complicity is absent, leading to less drive for mass mobilization. This -I think- provides an alternative explanation to the idea that people simply don't care.

What struck me here isn’t the hypocrisy or the oil math, but how little anything propagates anymore.

International law registers Iran as an internal affair. Protest registers morally. Markets register continuity. None of these layers talk to each other.

It’s a good illustration of how systems now remain stable without legitimacy because coordination and constraint satisfaction persist even when law, outrage, and intervention all stall.